Bridging the gap; County facing more than $100M in road and bridge repairs

Published 10:51 am Thursday, March 3, 2016

Mower County is facing more than $100 million in road and bridge needs for the next decade, and it’s unlikely any legislative action will fully address projected funding shortfalls of more than $6 million a year.

That’s the message Public Works Director Mike Hanson gave the county board Tuesday when he outlined the county’s extensive need for funding future road and bridge upkeep and repairs for Mower’s 405 miles of paved roads and 369 bridges.

The discussion was the first step for the board to formally begin discussing whether the county should explore a half-cent sales tax; however, board members voiced mixed opinions on how much discussion should take place before the upcoming legislative session.

The possibility of enacting the half-cent sales tax has been frequently talked about at county meetings in recent years. About two-thirds of the county’s Public Works budget comes from state aid, the gas tax and bridge bonds, while about 32 percent comes from local taxes.

Despite state transportation funding shortfalls being a much-discussed issue in recent years, the state Legislature failed to enact significant transportation funding fixes at last year’s session.

Now Mower, like many other counties, is looking into whether it should enact a half-cent local options sales tax to be used only on specific road and bridge projects.

Now Mower, like many other counties, is looking into whether it should enact a half-cent local options sales tax to be used only on specific road and bridge projects.

After reporting that Mower faces a roughly $100 million shortfall for road funding over the next decade, Hanson recommended the board move forward.

“It’s my recommendation that you do this,” Hanson told the board.

Hanson warned the board that current funding methods are unsustainable.

“If we don’t close this gap, you’re going to lose those pavements,” Hanson said. “And this is not just Mower County.”

The need

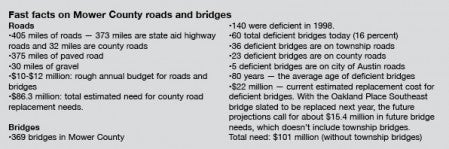

Of Mower’s 405 miles of paved roads, 375 miles are state aid highways — meaning the county receives state gas tax money to help maintain them — and 32 miles are on county roads, which don’t receive state funding. The county also has 30 miles of gravel roads.

About 53.5 percent of the county’s $10 to $12 million in annual expenditures go toward construction, with 28.6 percent going to maintenance, 11.6 percent to equipment and the shop, and 6.3 percent to administration.

Many roads haven’t been surfaced in 20 years or more in Mower County, aside from pothole fixes, and the need for road construction projects is $86.3 million.

“We’ve got pavements that are in need of a lot of work,” Hanson said. “We have a huge funding gap.”

The county maintains all 369 bridges on county, city and township roads based on a more than 100-year-old decision by the state Legislature. While the county currently has 60 structurally deficient bridges with an estimated cost of $22 million to fix them, that’s down from 140 deficient bridges in 1998. But with the Oakland Place Southeast bridge slated to be replaced next year, the future projections call for about $15.4 million in future bridge needs, which doesn’t include township bridges.

Despite progress, the need is still great as the average deficient bridge is about 80 years old, while other bridges continue to age.

“Even if you spend $22 million on those deficient bridges, you’re still going to have more bridges creeping up on you until the system is updated to a status where they will last a longer period of time,” Hanson said.

Hanson told the board the overall need for road and bridge projects is more than $101 million, which doesn’t include township bridges because Hanson said the money coming in for them is adequate to fund the work for the next 10 years.

For the next 10 years, the county is looking at an annual need of just under $10.2 million a year with about $3.3 million slated to come from the gas tax and $360,000 from reserves, which leaves $6.5 million unfunded.

“That’s fairly significant,” Hanson said.

Under current funding practices, those projects simply aren’t getting completed right now.

The county is projected to receive $1.5 million in 2017, $1.55 million in 2018 and $1.6 million 2019 if it enacts the sales tax. But that still wouldn’t meet the total need.

With the sales tax, annual funding would call for about $3.3 million from the gas tax, $1.5 million from the sales tax, about $360,000 from reserves and about $5 million unfunded.

Even if the Mower County board opts to eventually move ahead and enact a half-cent sales tax to fund road and bridge projects, the county would still face a shortfall on the need to repair and maintain roads in Mower County.

“Even if the sales tax is enacted, you’re going to have a huge gap annually in what you can actually do to these roads,” Hanson said. “You’re not going to be able to do the whole system with the sales tax. What’s needed is for the local funding to be tied with possible future legislative funding so we that close this gap once and for all.”

Board voices mix of concerns

The board is cautiously moving ahead on seeking public input on the plan at upcoming meetings, but commissioners voiced mixed opinions Tuesday on whether it should move ahead.

Commissioner Jerry Reinartz urged waiting until after the Legislative session to see what happens in terms of road funding, as he noted that adding more taxes for Mower County residents won’t be a popular decision.

“We got to give them a chance, though, because they’re aware everybody in Minnesota feels the same way we do,” he said.

Reinartz criticized the state for passing the buck of transportation funding down to the counties, adding he hopes representatives address it next week.

“I think it’s alright to start talking about it, but the Legislature goes into session next week,” Reinartz said.

But Commissioner Tim Gabrielson said that was the same case last year and no significant action was taken on transportation funding.

Hanson agreed, voicing doubts that anything would happen this year at the state level.

“Personally, I don’t see the Legislature doing anything this session,” Hanson said.

But even if the state takes actions, Oscarson cautioned the board it likely wouldn’t be the sweeping transportation changes that are likely needed, especially now that the state surplus has dropped a bit to about $900 million.

“We can’t rely on the Legislature to come to the complete rescue,” he said.

Oscarson also told the board that the legislative session will be long finished by the time the board eventually votes on whether to enact the sales tax this summer.

If the county board wishes to consider the sales tax, the next step is to instruct Hanson and his staff to complete the capital improvement plan ahead of public hearings, which could be done tentatively in July ahead of an expected vote on whether to approve or deny enacting the tax in August. The board also indicated it would seek extensive public feedback this spring and summer, and Oscarson recommended the board seek input for as many residents as possible.

Commissioner Mike Ankeny noted that Mower County’s agriculture-based economy is heavily dependent on roads, and allowing the infrastructure to deteriorate further without repair will only compound the problem.

“The cost will be way more, way more expensive to basically start from scratch than trying to repair what we have,” Ankeny said.

Oscarson noted the roads are an economic development issue too. With the potential for more people to live in rural areas as Mayo Clinic’s Destination Medical Center moves forward, the public will need good roads to get to and from work in cities.

While Ankeny has heard from people in support of enacting the tax, Commissioner Tony Bennett said he’s heard from people against the tax, adding residents have urged pressuring the state into funding roads.

While Gabrielson agreed the state needs to act, he said that the county likely needs to look into its options too.

“We cannot let them go any farther than they already are or we’re not going to have any base to even come back to, I believe,” Gabrielson said.

Board Chairwoman Polly Glynn, who represents mostly rural areas, told the board she expects rural residents to come forward asking for funding from the wind farm production tax to be pledged toward roads. In 2014, just under $1.6 million went to Mower County based on 2013 energy production — $1.27 to Mower County and about $318,000 was distributed among the townships with towers. The county is expected to get an additional $450,000 t0 $500,000 per year from the recently completed Pleasant Valley Wind Farm starting in 2017.

Glynn also said people would likely ask about the county’s wheelage tax, which brings in about $360,000 a year and is used largely for maintenance.

Right now, the production tax money goes into the county’s general fund to offset property taxes, and rural residents have routinely asked for that money to go toward rural roads since wind farms are in the rural areas.

But Gabrielson cautioned that the Legislature briefly discussed a plan that would change the way counties receive wind energy taxes in the future, and he still fears legislators may look into it again. He cautioned against spending or pledging money the county doesn’t yet have.

Looking forward

The half-cent sales tax is not uncommon. Steele, Fillmore, Olmsted and Freeborn counties have all enacted the sales tax.

Hanson noted dollars spent early on road projects can save money later, as more extreme fixes would be needed later if roads aren’t maintained and preserved.

Hanson added that Freeborn County did similar presentations last year on the way to enacting the tax and it still faces a $4.9 million shortfall — about 45 percent of their budget, according to Hanson.

“The need isn’t going to go away, but the local option sales tax would help to make that need smaller,” he said.

Looking at the funding and the shortfall, Hanson said the need to address the shortfall is dire and the need isn’t going to go away.

“You can’t fund them with what you have,” he said. “It won’t work. I’m telling you: It won’t work.”

“If you don’t fund them, they’re going to fall apart and you’re going to have nothing,” Hanson added.

Though Hanson and his staff outlined a timeline for discussions and eventual votes on the sales tax, the board is only moving ahead tentatively. The board instructed staff to schedule presentations at the spring township and city meetings on March 17.

The county board could then decide whether to move forward on the timeline to further explore the plan. If it does, Hanson and Public Works would come up with an updated capital improvement plan with a listing of projects the county would complete.

Then, Oscarson noted that the county would need to do extensive outreach as it moves forward by touching on several groups and types, and he noted other counties have talked with chambers, service groups and a variety of groups to get a vast array of feedback.