Group helps homeowners stop foreclosure

Published 10:28 am Tuesday, July 5, 2011

Help is on the way for homeowners at risk of losing their houses.

Minnesota homeowners can apply for the Emergency Homeowners’ Loan Program (EHLP), a new federal program to help those at risk of foreclosure.

Minnesota homeowners can apply for the Emergency Homeowners’ Loan Program (EHLP), a new federal program to help those at risk of foreclosure.

“The goal of the program is community stability and home ownership stability,” said Ed Nelson, a spokesman for the Minnesota Home Ownership Center.

The program targets one of the leading causes of foreclosure: underemployment and lack of income. Specifically, it’s aimed at owners who have missed payments due to economic or medical hardship.

“This is the first time that there’s been an effort to reach that target market,” Nelson said.

Eligible homeowners can qualify for as much as $50,000 in interest-free, forgivable loans to bring their mortgages current and assist with payments.

Applications are accepted from July 5 to July 22. The U.S. Department of Housing and Urban Development Authority will hold a lottery to select who receives the loans. Those selected will then fill out a full application. The loan is expected to benefit about 1,400 homeowners in Minnesota.

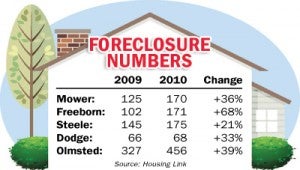

While many real estate agents have said the housing market has stabilized, foreclosures are still a steady concern, according to Elaina Johannessen.

“We kind of thought the bubble was going to burst in 2009, 2010,” said Johannessen, a counselor/supervisor with Lutheran Social Services of Minnesota (LSS), which manages foreclosure prevention for Mower County and much of the state. “What we’re seeing is that hasn’t kind of happened yet.”

“I think the numbers are pretty similar to what they have been in the last couple of years,” she added.

While HUD will choose who gets the loans, LSS and the Minnesota Home Ownership Center are looking to spread the word about the opportunity.

“We really want to get the word out there,” Johannessen said.

EHLP does have its gray areas. The program is targeted toward owners who plan to stay in their homes. Twenty percent of the loan is forgiven each year the owners live in their homes, meaning the loan would be completely forgiven in five years, according to Nelson.

If the owner leaves before five years, he or she would owe the remaining balance. Nelson said there are some areas of the loan that could still be addressed or altered.